nj property tax relief check

Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. NJ Tax Relief for Texas Winter Storm Victims.

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

Local property-tax bills have grown by no more than 24 year-over-year since the 2 cap went into effect in 2011.

. The state of New Jersey provides senior citizens and people with disabilities with some relief regarding property taxes. The appropriate stub will be retained by the office. What You Should Know About the NJ Property Tax Deduction for Senior Citizens and Disabled Persons.

Murphy has proposed a 489 billion budget that boosts K-12 funding makes a full public pension payment for the second straight year. Ad Mortgage Relief Program is Giving 3708 Back to Homeowners. Somerset County Office on Aging.

Payments of cash or check are received at the Tax Office during regular business hours. Create a free account and get a full rundown like the sample below. Send your check with the appropriate stub from the bill to 50 Washington Avenue Dumont NJ 07628.

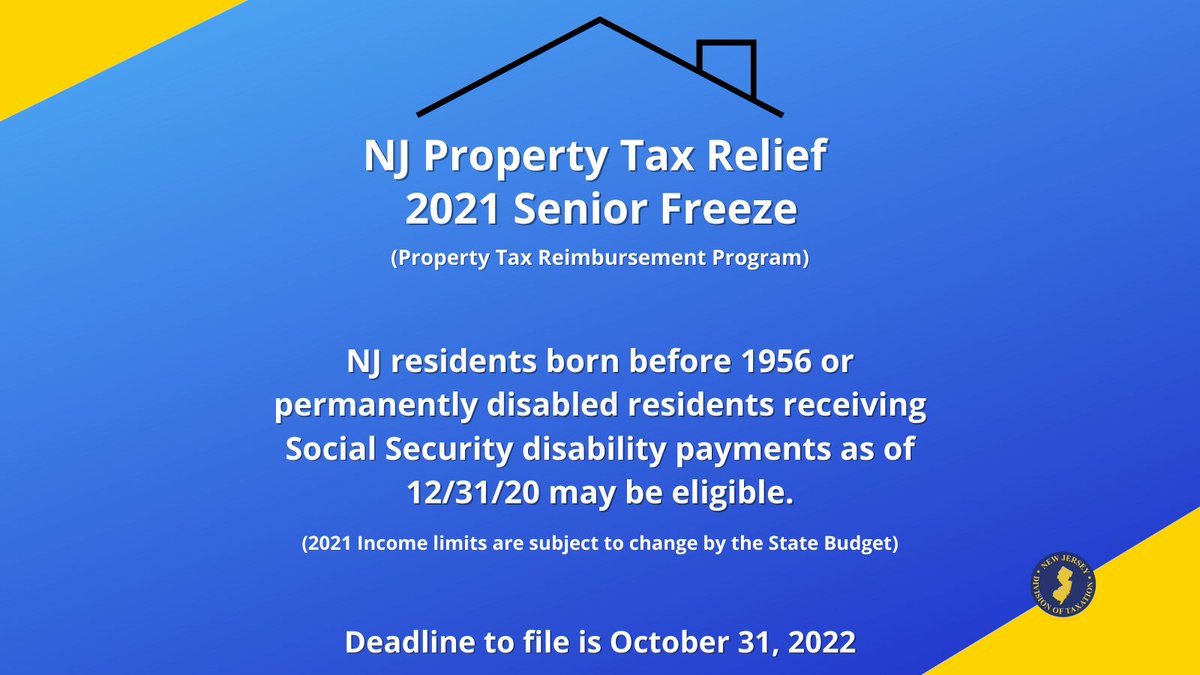

August 1st November 1st February 1st and May 1st. The deadline to file the application is October 31 2022. Payments received after the 10-day grace period will be considered delinquent and subject to interest NJSA.

You can pay your tax bill by mail with a check or in person using a check or cash. Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. 2021 Senior Freeze Applications.

In addition to that primary function the office also maintains tax records and provides tax information to the public and assists eligible residents in applying for property tax relief programs offered by the state. TRENTON Property taxes in New Jersey climbed by nearly 2 again last year restrained by the cap but still amounting to a 583 million tax hike. Renters get help too.

When a property is included in the tax sale a lien is sold for the amount of the eligible municipal charges together with interest to the date of the tax sale and costs of sale. Office on Aging First Floor 27 Warren St. The Freeze Act Division of Taxation Satellite Office 75 Veterans Drive Somerville NJ 08876 Phone.

Read the New Jersey Property Taxpayers Bill of Rights. TB-103 Initial Guidance on New Jerseys Conformity to IRC Section 1502 for Combined Returns. Depending on the amount of the lien.

How to Apply. We will begin mailing 2021 applications in early March 2022. All property tax relief program information provided here is based on current law and is subject to change.

All payments must be made by cash check or money order. After July 1 2017 any applicant for certification that cant obtain a Premier Business Services account may submit a paper application Gtb-10 for business assistance tax clearance. For the November quarter due to the accelerated tax sale payments received after 400 PM on November 10 must be made by bank cashier check or money order.

Google Translate is an online service for which the user pays nothing to obtain a purported language translation. These bills are for new construction additions andor. Interest rates for liens sold may be as high as 18.

The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as Google Translate. New Jersey Property Tax Reimbursement Application Forms and the Homestead Rebate. Tax appeal forms are available and must be filed with the County Board of Taxation by April 1st of the current year at One Bergen County Plaza 3rd Floor Hackensack NJ 07601.

2019 Senior Freeze Property Tax Reimbursement The Governors budget fully funds the 2019 Senior Freeze program. Property Tax Relief Program UPDATE. This page is for Income Tax payments filings and inquiries - as well as for repayments of excess property tax relief benefits Senior Freeze or Homestead BenefitIt cannot be used to make Inheritance or Estate Tax payments.

The Township of Greenwich has adopted by Resolution an Interest rate of 8 for. 1st quarter watersewer utility bills are due 312021 Property Taxes Property tax bills are mailed annually once a year after June 1st and payments are due quarterly as follows. The statewide tab now exceeds 31 billion.

Immigrants who pay taxes could get 500 pandemic relief check under Murphy budget. Go here if you want to pay other taxes online. The user is on notice that neither the State of NJ site nor its.

Please visit wwwcobergennjus or call 201336-6300. Refine your research with detailed tax information such as rates and exemptions for your property of choice. Check Your Eligibility Today.

09 2022 124 pm. 2017 Homestead Benefit 2017 Homestead Benefit payments will be paid to eligible taxpayers beginning in May 2021. According to an NJ Spotlight News analysis the average property-tax bill in 2021 would have been roughly 12800 not the actual nearly 9300 if the bills had grown over the last decade at the same rate they did during the decade before the 2.

The Tax Collectors office is responsible for the billing and collection of property taxes and sewer fees. Payments are expected to be mailed to eligible taxpayers beginning on October 15 2020. New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of Taxation.

Phil Murphy announced Thursday his administration will extend property tax relief to about 18 million New Jersey households by. If you meet certain requirements you may have the right to claim a property tax deduction of 250 per year. The New Jersey County Tax Boards.

Phil Murphy proposes property tax rebates starting at 700 and growing to 1150 including homes with incomes of up to 250000. As a statutory officer of the State of New Jersey the Tax Collector is obligated to follow all the State Statutes regarding property tax collection including billing due dates interest on delinquent tax payments and tax sale procedures. In-depth Monmouth County NJ Property Tax Information.

The tax sale includes delinquent taxes as well as delinquent water and sewer charges as dictated by New Jersey statutes. 09 2022 549 pm. Phil Murphy gives his 2023.

If this is your first time filing a tax return with New Jersey you cannot use this portal to make a payment. Please remember that a receipt will be provided only if you send or bring the entire bill this means the upper portion of the bill as well as the stub. Offical Website of Sea Isle City NJ.

Mortgage Relief Program is Giving 3708 Back to Homeowners. See detailed property tax information from the sample report for 1604 Birchwood Lane Monmouth County NJ. Check Your Eligibility Today.

2020 Income Tax Filing Deadline Automatically Extended to May 17 2021. The new program would lower the effective average property tax cost back to 2016 levels for many households that have been ineligible for. TB-90R Tax Credits and Combined Returns.

Deducting Property Taxes H R Block

Tax Collector S Office City Of Englewood Nj

Nj Property Tax Relief Program Updates Access Wealth

The Official Website Of The Borough Of Wood Ridge Nj Tax Collector S Office

My Nj Tax Return Not Picking Property Tax Deductio

Freehold Township Sample Tax Bill And Explanation

Nj Div Of Taxation Nj Taxation Twitter

Freehold Township Sample Tax Bill And Explanation

My Nj Tax Return Not Picking Property Tax Deductio

Florida Property Tax H R Block

Murphy S Property Tax Rebate Proposal Adds Renters Youtube

Nj Property Tax Relief Program Updates Access Wealth

Senior Freeze Homestead Benefit Programs River Vale Nj

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

My Nj Tax Return Not Picking Property Tax Deductio