does fla have an estate tax

The state constitution prohibits such a tax though Floridians. Federal Estate Taxes.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Call us at 561 408-0729 or visit.

. Its called the 2 out of 5 year rule. Counties in Florida collect an average of 097 of a propertys assesed fair. Florida does not have an estate tax or income tax so the only taxes that can apply to a Florida estate are federal taxes.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Florida doesnt have an inheritance or death tax. As noted above the Internal Revenue Service IRS requires estates with combined gross assets and prior taxable gifts exceeding 1170 million for the.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Note this is required only of individual estates that. Florida also does not have a separate state estate tax.

In 2022 the estate tax threshold for federal estate tax. Due nine months after the individuals death. Floridas general state sales tax rate is 6 with the following exceptions.

In Florida homeowners do not have to pay property taxes to the state government. While many states have inheritance taxes Florida does not. Some people are not aware that.

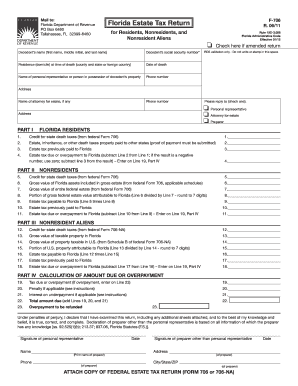

Federal estate tax return. Instead it is the local governments that collect property taxes which serve as their main source of funding. Inheritance Tax in Florida.

However the federal government imposes estate taxes that apply to all residents. Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005. Federal estate taxes are only.

Heres an example of how much capital gains tax you might. The average property tax rate in Florida is 083. Each county sets its own tax rate.

The blogs to follow will address specific issues to guide buyers to understand the process better and to help them avoid many of the pitfalls. Cannot increase by more than 3 of the previous years assessment or the Consumer Price Index whichever is less. Does Florida Have an Inheritance Tax or Estate Tax.

It lets you exclude capital gains up to 250000 up to 500000 if filing jointly. An estate is assessed an increasingly higher tax rate starting at 18 and capping out at 40 depending on how much the estate is worth over the 1118 million threshold. The strength of Floridas low tax burden comes from its lack of an income tax making them one of seven such states in the US.

There are also special tax districts such as schools and water management districts that have.

Estate Gift Tax Changes In 2022 Dmh Legal Pllc

New Tax Implications Vero Beach Florida Vero Beach Lawyer Vero Beach Attorney Jennifer D Peshke

Estate Planning Tips Married Floridians Need When They Near The Proposed Tax Limits Elder Law Attorney St Augustine J Akin Law

Florida Estate Tax Rules On Estate Inheritance Taxes

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Does Your State Have An Estate Or Inheritance Tax

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

Notice Of Federal Estate Tax Return Due P 3 0950 Pdf Fpdf Doc Docx

Florida Property Tax H R Block

Florida Estate Tax Return F 706 Fillable Online Form Fill Out And Sign Printable Pdf Template Signnow

Florida Taxes A Look At The Difference Between Florida And Other States

Does Florida Have An Inheritance Tax

Estate Tax Should Target The Wealthy Not Middle Class Lowell Sun

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Moving To Avoid Estate And Inheritance Tax Njmoneyhelp Com

Does Florida Have An Inheritance Tax Doane And Doane P A